HTX Suspends Proof-of-Reserves Amid TUSD Concerns

What is HTX?

HTX is a crypto exchange where people can buy and sell different types of digital currencies. It's like a marketplace for cryptocurrencies. One of the things that HTX used to have was a feature called proof-of-reserves. This feature showed how much cryptocurrency HTX had in their possession.

What Happened?

Well, today a fintech analyst named Adam Cochran noticed that HTX had deactivated their proof-of-reserves feature. This happened at the same time when there were some problems with a stablecoin called TrueUSD (TUSD). A stablecoin is a type of cryptocurrency that is supposed to always be worth $1.

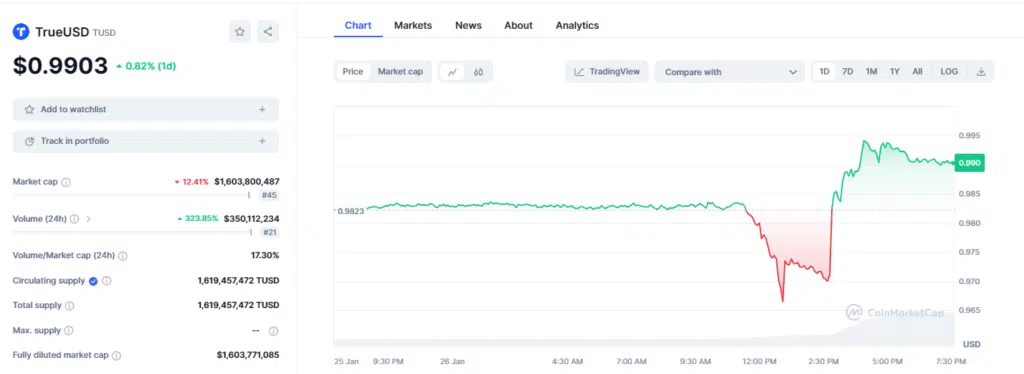

But here's the thing, TUSD has been struggling to stay at $1 for more than two weeks. And it turns out that Justin Sun, who is connected to HTX, is one of the people involved with TUSD. So, there are some concerns about whether TUSD is really worth $1 or not.

HTX's Cryptocurrency Holdings

Now, let's talk about HTX's cryptocurrency holdings. A website called DefiLlama showed that HTX had about $120 million worth of a cryptocurrency called ETH. But in the latest audit, it was reported that HTX had almost $300 million. So, there seems to be a difference in the numbers.

Earlier today, HTX's proof-of-reserves webpage didn't show any information about their cryptocurrency holdings. It was like a blank page. But don't worry, they fixed it and now the page is back to normal. But some people are wondering why this happened, especially when there are already concerns about TUSD.

1/8

— Adam Cochran (adamscochran.eth) (@adamscochran) January 26, 2024

So Justin Sun's HTX/Huobi has suddenly turned off their proof-of-reserves system, at the same time as a few other concerning things are happening. pic.twitter.com/eCjE9YAvwA

2/8

— Adam Cochran (adamscochran.eth) (@adamscochran) January 26, 2024

Their live reporting on DefiLlama shows only about $120M in ETH assets despite their last audit claiming closer to $300M in raw ETH. pic.twitter.com/JFBqADzq27

Concerns About TUSD

So, what's the deal with TUSD? Well, there have been some worries about whether TUSD actually has enough money to back up its value of $1. Since January 7th, the value of TUSD has gone below $1, according to CoinMarketCap.

And things got even more concerning when TUSD couldn't show proof that they had enough U.S. dollars to support the stablecoin. This made people think that maybe TUSD doesn't have enough money to back it up.

So, there you have it, middle schoolers! HTX turned off their proof-of-reserves feature, and there are some concerns about TUSD. It's all about the world of cryptocurrency and how things can sometimes get a little complicated. But don't worry, we're here to break it down for you!

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Please do your own research before engaging in any cryptocurrency-related activities.

Below Are Crypto Related Article.

Silk Road Drug Lord Gives Up $150 Million in Biggest Crypto Seizure by DEA

U.S. Government Plans to Sell $131 Million in Bitcoin Seized from Silk Road

Bitcoin: A Long-Term Hedge Against Inflation

Solana Launches 'Token Extensions' for Enhanced Developer Control and Compliance

%20(1)%20(1).jpg)